Bitcoin mining how much

To get to that answer you need to consider the following:

To get to that answer you need to consider the following:

- Consider which mining rig you want and can afford, will you build it yourself or will you buy an ASIC ready made rig? Nowadays, the only feasible mining rigs for bitcoin are ASIC's.

- Cost of electricity, calculate costs there. You should look into somehow finding free electricity or set up your miners in places where electricity costs are very low.

- Join a pool. Rather than trying to mine all by yourself, you can pool your resources or hashing power with other miners. Miners in pools earn a share of the coins mined by all members.

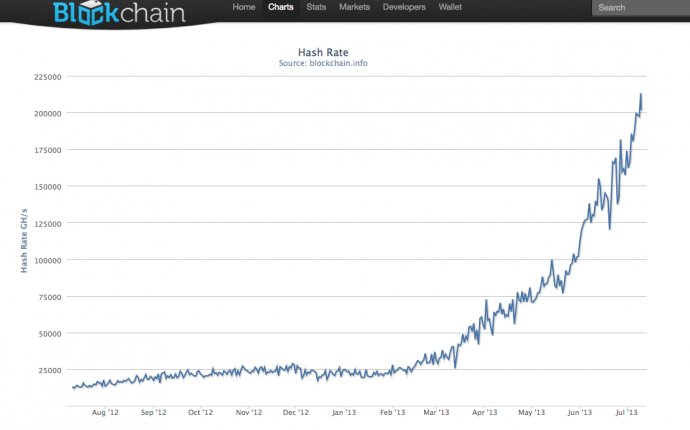

- Difficulty levels are another thing to monitor very closely. As bitcoin's difficulty increases you might begin to see your long-term profitability being affected.

- Price is another very important thing to monitor closely. If the difficulty increases and consequently the price drops than you're definitely in hot water.

- Excess heat. These miners produce unprecedented amounts of heat.

- Downtime. Electricity shuts off, hardware inside the miners break, miners themselves break. You get the picture.

Once you've looked into all these factors, I would then calculate the profitability of the miners. There are many online profitability calculators in which you can input the parameters I've mentioned above.

Source: www.quora.com