Bitcoin rate Euro

Volatility is a well-recognized impediment to the success of Bitcoin as a currency. An example of the argument for volatility-based caution about Bitcoin, chosen at random, appears in Professor David Yermack’s December 2013 NBER working paper, “Is Bitcoin a Real Currency? An Economic Appraisal.” Wide swings in the price of bitcoins vis á vis other things will obviously tend to suppress its utility as a store of value or unit of account. Nobody wants to deal with recalculating prices denominated in Bitcoin day over day or hour over hour.

Volatility is a well-recognized impediment to the success of Bitcoin as a currency. An example of the argument for volatility-based caution about Bitcoin, chosen at random, appears in Professor David Yermack’s December 2013 NBER working paper, “Is Bitcoin a Real Currency? An Economic Appraisal.” Wide swings in the price of bitcoins vis á vis other things will obviously tend to suppress its utility as a store of value or unit of account. Nobody wants to deal with recalculating prices denominated in Bitcoin day over day or hour over hour.

But I’ve long felt the volatility knock on Bitcoin to be slightly unfair. My favorite response line has been to say that judging Bitcoin based on its current volatility is like declaring a 10-year-old unfit to play in the NBA because he’s too short.

As a new asset class (or very different member of the “cash or cash equivalent” asset class), Bitcoin has yet to find its place in the world. The uses to which it is put will ultimately translate into a dollar price based on a recognized, relatively steady level of demand. Right now, speculation about where demand for Bitcoin will end up takes place in thinly traded markets. Just those two ingredients — uncertain future use and thin markets — are recipe enough for plentiful volatility.

But there’s every reason to believe that the market for Bitcoin will deepen and grow in sophistication, tempering its volatility. The capacity of the Bitcoin protocol to transfer and store value in exciting new ways will produce transaction demand — supplanting speculative demand, which today dominates because of anticipated price appreciation. Transaction or “use” demand will also increase because of Bitcoin’s capacity to administer countless economic and social functions beyond value transfer, including messaging, proof of authorship, land and title registry, and identity/naming. This will drive volatility down, I believe, both because it will shift bitcoins out of speculation and because it will give the markets more concrete information about what use demand is and will be.

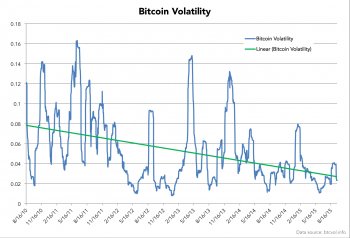

Based on an estimate from two years ago or so — eons in Bitcoin time — I spent much of 2014 saying that Bitcoin volatility was dropping at a rate of about two or three percent per year. This suggested that it would have dollar-price stability similar to that of the Euro in ten to fifteen years. That’s not bad for an all-new currency (or whatever Bitcoin is). It’s looking, though, like that time estimate was wrong.

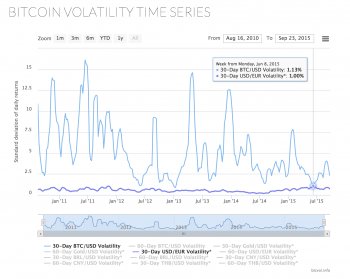

Eli Dourado at the Mercatus Center recently updated his site for tracking Bitcoin volatility to include some other currencies and assets. The update opens new and interesting windows. In particular, it reveals that earlier this year, the Euro and Bitcoin had nearly the same 30-day volatility against the dollar. On June 8th, Bitcoin had volatility of 1.13% and the Euro’s was 1.00%.

Eli Dourado at the Mercatus Center recently updated his site for tracking Bitcoin volatility to include some other currencies and assets. The update opens new and interesting windows. In particular, it reveals that earlier this year, the Euro and Bitcoin had nearly the same 30-day volatility against the dollar. On June 8th, Bitcoin had volatility of 1.13% and the Euro’s was 1.00%.

That doesn’t suggest at all that Bitcoin’s volatility problem is solved. When the two volatilities air-kissed, Bitcoin’s was near a historic low and the Euro’s was at a high. Bitcoin’s volatility has risen again since, with jumpy Bitcoin prices attributable to the summer’s machinations in Greece and Bitcoin’s “blocksize” debate. But the overall trend shows a marked and relatively rapid drop in volatility relative to my earlier prediction of ten- to fifteen-year parity.

Using Dourado’s data, it’s easy to make a graph that, while far less attractive, shows the strong downward slope to Bitcoin’s volatility. That trend won’t continue, and it will still be some while before Bitcoin has the kind of low volatility that makes it a reasonable store of value or unit of account for people whose alternatives are the dollar, the Euro, and other major currencies. But many people around the world are not in that category. They may adopt Bitcoin to protect themselves from local currencies with even greater swings, or consistent loss of value. This will improve the volatility picture for the rest of us.

I see many virtuous dynamics around Bitcoin volatility in the offing. These may be relevant, or they may be evidence of my need for education. Eli takes pains to point out on his site that the Bitcoin and Euro volatility numbers are incompatible because markets for fiat currency are closed on weekends and holidays. The data “are presented for entertainment purposes only, ” he says. I agree with the sentiment, and offer this post in the same spirit.