Use cases for blockchain

Blockchain as a disruptive enabler

Blockchain as a disruptive enabler

Blockchain first appeared in our general consciousness as a result of Bitcoin. Whilst the Jury may be out on Bitcoin, Blockchain has made waves by showing a valuable contribution to the financial services industry. So what is it and what of the opportunities to apply Blockchain as a facilitator of disruption in other sectors?

Ok, so lets start with my regular health warning here… These are my opinions and observations. They are based on the work I perform at board level with many leading, large listed businesses seeking to get the most from their disruptive initiatives. I also have to stress that this is not an exhaustive exploration Blockchain, but instead, a primer setting out some observations about how Blockchain is making waves.

Background to Blockchain

Essentially, in Bitcoin transactions, Blockchain provides the evidence of the activity, trades and transfers on the network. A block is the ‘current’ or realtime part of a blockchain that records some or all of the recent transactions, and once the activity is complete, it goes into the blockchain which acts as a permanent database in a ledger like fashion. Every time a block is completed, a new block is generated and this leads to an endless quantum of such blocks in the blockchain. Blocks are not placed in the chain at random. Instead, they are linked to each other in a linear, chronological order with each block containing a hash of the previous block.

Whilst Bitcoin fuelled greater awareness of Blockchain, it is key to remember that a blockchain is a cryptographically protected and publicly hosted record of events and agreed-upon variables. The real defining feature is not what it does or how it does it, instead, it holds value based on how much users can trust it to perform those services impartially. Think of it as a trusted intermediary and this is where the exploration of other use cases starts.

Whilst Bitcoin fuelled greater awareness of Blockchain, it is key to remember that a blockchain is a cryptographically protected and publicly hosted record of events and agreed-upon variables. The real defining feature is not what it does or how it does it, instead, it holds value based on how much users can trust it to perform those services impartially. Think of it as a trusted intermediary and this is where the exploration of other use cases starts.

So… why the buzz?

Blockchain has truly got the financial services industry buzzing with the Bank of England busy considering how best to harness the technology, and where the Bank of America has already applied for no less than 15 patents, with a further 20 still in progress yet to be submitted. Yet the potential of Blockchain extends far beyond the financial services sector, and here I explore a brief look at just what this revolutionary technology could mean for a number of other sectors.

A quick look at the basics of Blockchain

The basic premise of Blockchain is an incredibly simple one at heart – its a database of sorts created in a different way and it facilitates any and every one to undertake transactions between each other. But, most notably, it does so in a completely transparent and secure fashion. When considered in this way we see that Blockchain could potentially be used whenever and wherever there is some form of exchange between two parties, and it really needn’t be solely financial.

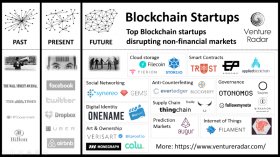

Blockchain Capital: Revolutionaries

Leading the way for what could be possible within other realms with Blockchain is ‘Blockchain Capital’ who have raised $7 million to explore just what can be achieved for those within non-financial sectors. They found that there are already many companies harnessing Blockchain; such as La’Zooz, the ride share company that is empowering its points based value transfers; BizHealth, who are decentralising patient records management and Otonomos who are digitalising company incorporations, as well as the transfer of equity and ownership of such companies.