Using blockchain for insurance

Customer Identity:

A consortium of insurers, KYC databases and notary networks can verify the identity of its customers and store it in a shared ledger. Any new customer coming to the network will submit his identity proof and the notary will be able to validate the data by comparing it with the government databases which will be executed outside the network. The verified data is now available for all the network participants.

Data once digitally stored and verified can be used by multiple entities within the Blockchain, of course, with the consent of the customer. This will reduce the burden on the customer of submitting KYC documents multiple times, thus enhancing the customer experience.

Smart Underwriting:

Smart contract-enabled underwriting process can be executed by the insurer to fetch customer data from third party systems. As soon as a customer is registered, based on the opted policy, the relevant data is fetched from the third party databases; for instance, DMV database in case of consumer auto insurance. The data is used by the underwriter to finalize the premium amount and finalize the terms of the new policy for different lines of business. Once settled, the policy details are incorporated in a smart contract which will self-execute when a claim has to be processed.

Blockchain eliminates the extended document submission and third party verification process, which in turn accelerates the underwriting process as well as reduces cost.

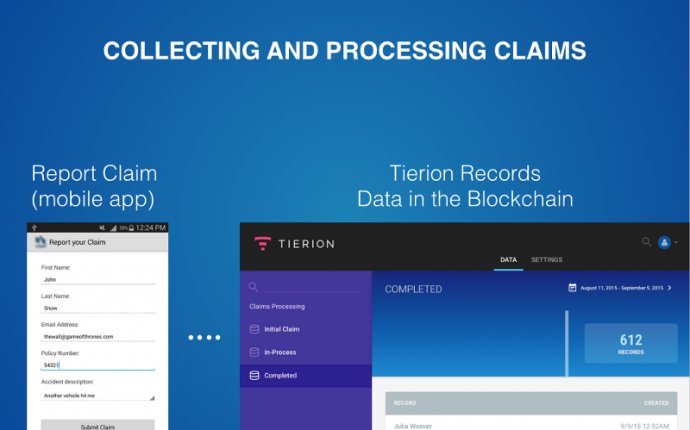

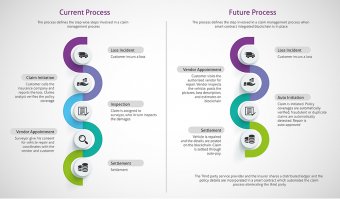

Fraud Management and Auto Initiation of Claims:

Insurers can automate the claim process by integrating with third party vendors and manage fraudulent claims by forming a consortium network with insurers. Any claim raised against an event is shared in the network and verified by the participating insurers to identify fraudulent multiple/duplicate claims.

A smart contract-enabled platform, integrated with Blockchain, can be leveraged for process automation. When a customer opts for a service from a third party vendor who is part of the Blockchain network, the smart contract is triggered with the event details. The smart contract executes policy conditions with the claim process and shares a brief report with claims administration for final settlement.

Blockchain brings-in transparency by identifying fraudulent duplicate claims and makes the claim process hassle-free for both, the insurer and the insured.

Audit or Regulatory Benefits:

A Blockchain network where regulators or auditors are also participants can have an accurate picture of the company’s accounts. Organizations can have private Blockchain networks within the firm where different departments are the participants and the data is shared with an auditor who is also a participant. This could definitely be useful during audits – both internal and external, especially financial audits.

Blockchain system allows multiple separate internal users access the data, while giving none of them the authority to reset or roll it back – that’s an excellent property for an audit logging system.

Conclusion

The insurance industry is in a very nascent stage in terms of adopting Blockchain technology. A few insures are investing in research and building PoCs. Allianz has tied up with an insure-tech startup to implement the technology in catastrophe bonds; Lloyd has implemented a Blockchain solution for sharing economy. While challenges and uncertainties remain, the advantages that Blockchain has to offer is sure to encourage insurers to adopt it.