Bitcoin miners fees

With the surging popularity of Bitcoin, congestion on the Bitcoin block chain is rising. This has severe implications for the cost of a bitcoin payment.

With the surging popularity of Bitcoin, congestion on the Bitcoin block chain is rising. This has severe implications for the cost of a bitcoin payment.

Constrained Supply and Rising Demand

Miners currently observe a 1mb limit on the overall size of each Bitcoin block, which constrains Bitcoin to around 300, 000 transactions per day. We’ve been bumping up against this limit for the last 3 or 4 months. As a result, a fee market in Bitcoin is developing, and we are seeing dramatically rising miner fees on a daily basis.

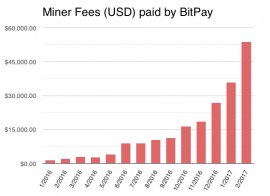

Below is a chart of the miner fees BitPay has paid each month over the last year. The data does not reflect miner fees paid by people paying a BitPay invoice or fees paid by users paying from a Copay or BitPay wallet. These are the fees BitPay has paid to transfer its own bitcoin. The fees are normalized to USD to factor out the rising price of Bitcoin.

Over the time frame shown, our monthly miner fee expenditure has risen 35-fold. If we factor out our transaction growth of nearly 3x, it is still nearly a 12-fold increase. The fees aren’t just rising, they’re rising exponentially. At some point, an equilibrium will be reached and we will discover the true value of having a transaction secured by the most powerful computing network mankind has ever deployed.

The value of our average transaction is also rising. Many of the businesses we’ve signed up over the years have started using BitPay for B2B supply chain payments. And we have more and more enterprises signing up every day that need to make very large international plant and equipment related payments. For these customers, miner fees of a few dollars are irrelevant. It appears that transactions for high value use cases will eventually crowd out smaller on-chain payments, and smaller payments will move off-chain.

What Happens Next?

Some people believe that an alt-coin will rise and take over. We think that’s unlikely. What is actually happening is that a market is forming between on-chain, mining-secured payments and off-chain, more conventionally secured payments. An off-chain payment could take the form of an alt-coin transaction, but the reduced security, increased volatility, and lack of liquidity of an alt-coin is going to make that a less attractive option. And, if several projects (like the lightning network) materialize, off-chain payments will become safer and more secure than more conventional off-chain payments. On-chain payments will still be the most secure option, but with adequate alternatives, demand for on-chain payments will abate. The most important competition is not between Bitcoin and an alt-coin, it is between on-chain and off-chain transactions.

In 2011, I would have never imagined we’d still be living with a 1mb block size limit in 2017. At the time, most people expected that the limit would be increased a few times until we started to experience real scaling limits imposed by physics. But in some sense, it’s a good forcing function to develop real alternatives to on-chain transactions and let a market between fully trustless on-chain transactions and trusted (or semi-trusted) off-chain transactions develop.

As off-chain transactions in one form or another are increasingly adopted, market share growth will start to diminish for miners. With their considerable investments at stake, they will be under pressure to increase transaction throughput to compete with off-chain payment solutions. We estimate that Bitcoin needs to achieve an approximate 100 fold increase in throughput just to be viable as a savings and settlement medium (aka digital gold). Market forces will push in that direction, but we need seamlessly inter-operable off-chain solutions to relieve some of the pressure while work is done to safely increase on-chain throughput.

Final Thoughts

Markets and economics will eventually overwhelm any ideological stance community members hold. Miners may be compelled to increase the block size limit leading to a disorderly hard fork experiment. On the other hand, a user revolt might lead to a minority fork with equally disorderly results. Both sides of the debate seem to believe that Bitcoin will be destroyed if the other side gets their way. We are somewhat less fatalistic — we believe a variety of scaling solutions will materialize, and Bitcoin will enjoy continued success.