How to make money with Bitcoin trading?

Bitcoin arbitrage trading is a way to make money trading bitcoin with less risk than speculative bitcoin trading or day trading.

Trading bitcoin is risky business, this is a fact. The price can swing wildly, and nobody knows for certain what the price will be from day to day. If you know the bitcoin market, it is possible to read the market signals and make trades based on what you think might happen. This could make you money, and it can lose you money, but in essence, its a gamble.

Bitcoin arbitrage trading is one of the best ways to make money trading bitcoin without having to worry as much about sudden price movements that could lose you money. It is a quick and safer way to trade than basing trades on what the chart is ‘telling you’.

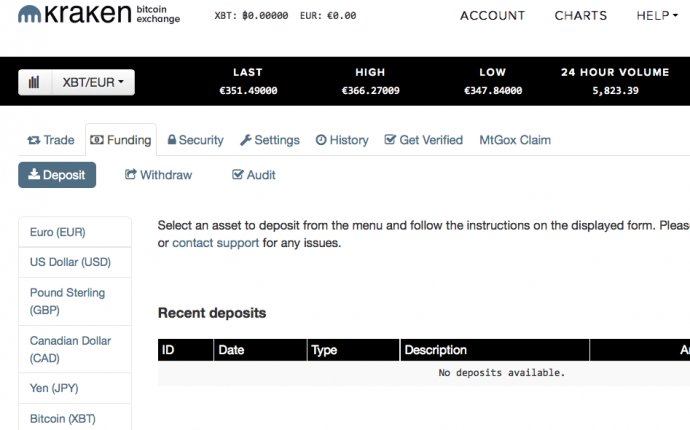

If you are serious about trading bitcoin and making money, you will have bitcoin on as many different exchanges as possible, and have yourself setup to buy or sell bitcoin on as many different platforms as possible. Why? So that you are able to take advantage of the best prices on any given platform at any time.

What is bitcoin arbitrage trading?

Bitcoin arbitrage trading is when you simultaneously buy and sell bitcoin to make a profit from the difference in price on bitcoin exchanges.

Bitcoin arbitrage trading is when you simultaneously buy and sell bitcoin to make a profit from the difference in price on bitcoin exchanges. You exploit the difference in price on different exchanges, and keep the change as free money.

If Exchange A has a bitcoin price of R9000 and exchange B has a bitcoin price of R9150, you can take advantage and exploit the price difference, by taking the R150 difference for yourself, easy and free money / bitcoin. You simultaneously buy bitcoin on the cheaper exchange, and sell bitcoin on the more expensive exchange.

If you buy 1 bitcoin for R9000 on exchange “A”, and sell 1 bitcoin for R9150 on exchange “B”, you still end up having 1 bitcoin, except you also have an additional R150 that you didnt have before. Free money right?!

If you have enough bitcoin and money available to do this properly, and there is enough liquidity on the exchanges, you can do it all day long, taking R150 for free in each trade, while still keeping the same amount of bitcoin, but you needs to consider the fees…

What do you need in order to do bitcoin arbitrage?

When you want to buy bitcoin, why pay more than you need to? Look at the prices on the different exchanges and platforms you are registered and simply buy from the cheapest. If you are selling, you would sell on the most expensive, so that you get the most money possible for your bitcoin. We recommend IceCubed and Bitx in South Africa.

In order to do arbitrage trading, you need to have accounts at more than one bitcoin exchange to also take advantage of both the high and low prices. The bigger the difference in price between the exchanges, the more profit you can make. The more exchanges you are a member of, the better you can exploit the price differences between them.

If you see a large price difference between bitcoin exchanges, don’t ask questions, take advantage and keep the difference in price as free bitcoin!

You will need to have some funds in either fiat currency like Rand, or bitcoin, but even better would be to have funds available in both currencies. In this case you literally need money to make money!

If you have bitcoin and Rand, you can deposit the Rand into the exchange with the cheapest bitcoin price, and deposit the bitcoin into the exchange with the most expensive bitcoin price. To keep things simple, you could buy and sell the same amount at the same time.

What about trading fees?

If the difference in price between exchanges is small, you might lose money doing arbitrage trading, once the fees for your trade come off! It is best to know what your fees are going to be beforehand, so that you can factor that into your calculations.

If the trading fee is 1% to take a trade on each exchange, then assume that in the worst case scenario, you will pay 1% on the buy and sell of the bitcoin, and should cost that in. With a bitcoin price of R9000, 1% is equal to R90. Paying that on both exchanges means there needs to be a price difference of at least R180 for you to make any profit at all.

In South Africa BitX has a fee structure where you dont pay any fees if you are the one who makes the trade, so you can avoid the R90 fee to buy a bitcoin for R9000 if that is the price on the exchange, by making a trade for R9001, and waiting for someone to take your price.

This will make the buyer of your bitcoin pay the R90, and you dont pay anything. Using this method, you can eliminate 50% of your arbitrage trading fees by simply making trades instead of taking trades.

The problem with this method is that bots and other traders might see your bid and change their price to go in front of yours. Get around this by changing your price again so that you go ahead of their price by R1. As long as you are below the R9090 by the time you have sold your bitcoin, even if its piece by piece, you will still come out of it paying less fees. This can be a slow process, and sometimes it can be extremely quick you never know who is trying to buy or sell at the same time as you are.

The best times for bitcoin arbitrage is in times of high bitcoin price volatility. When the price is moving up or down quickly, often the exchanges have big differences in the prices on the order books and this is when you can usually make the most profit from bitcoin arbitrage trading.

An example to see how it could be done

I will show you an example I just did…

I will show you an example I just did…

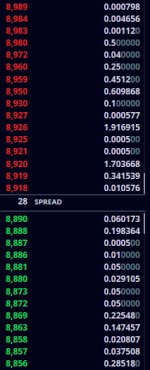

The price on IceCubed was R8690 vs RR8890 on BitX. A R200 difference is cool, but that could be eaten away by trading fees…

On BitX at the time, the best asking bid was R8890 and if I sold the bitcoin for that bid, I would pay the 1% taker fee for taking that trade. I would still make a profit of R24.20 (R8890 – R88.90 fee = R8801.10 total – R8776.90 cost = R24.20 profit) . The order book was very thin on bitx at that time though, and that price is only available for a small amount of the bitcoin I had to sell.

One solution was to make my own SELL bid on BitX, lower than the other sell bids, and higher than the BUY bids. I could put in a SELL order for R8900 for example and hope that someone will take my trade. In this case I would pay ZERO trading fees. If someone bought that bitcoin at that price, my profit would be R123.10 (R8900 – R8776.90 cost = R123.10 profit)

This might not sound like a lot of money, but doing this all day long, on multiple exchanges, can add up to hundreds or thousands per day.