Bitcoin mining hardware calculator

There are ways to profit with bitcoin mining. Ways to earn from bitcoin mining typically involve upfront investment of mining hardware. Raw mining earnings are calculated by mining power of your bitcoin mining hardware, measured in hashes per second, and the current difficulty and block reward of the bitcoin network.

There are ways to profit with bitcoin mining. Ways to earn from bitcoin mining typically involve upfront investment of mining hardware. Raw mining earnings are calculated by mining power of your bitcoin mining hardware, measured in hashes per second, and the current difficulty and block reward of the bitcoin network.

Most modern hardware measures its power in TH/S (trillion hashes per second) please note that bitcoin mining is not a get rich quick scheme. This article will discuss the factors affecting profit, best process to follow to make a profit if it’s possible with your power costs, limitations on small scale operations, how to secure your earnings from theft/loss, alternative mining options, and prospects of making a profit. This is a moderate risk investment and many factors which will be discussed in this article must be considered.

What factors affect profit?

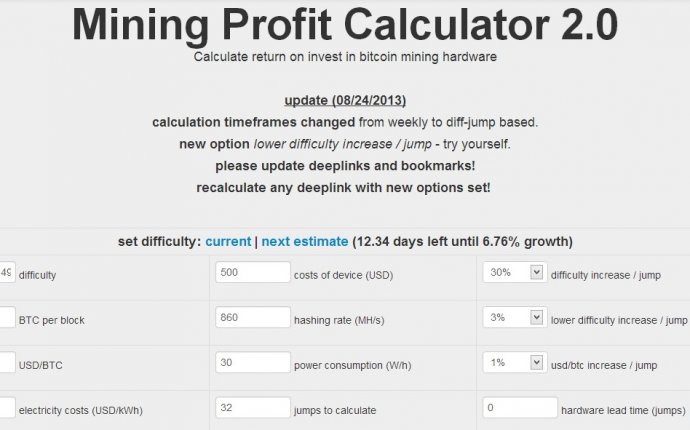

- To earn from bitcoin mining you need to consider the following in your bitcoin mining calculation:

- Upfront hardware cost, the price you pay for the hardware

- The mining power of your hardware, in TH/S

- Mining difficulty

- Power consumption of the hardware

- Your electricity cost

- Climate of your country

- Bitcoin price

- Block reward, which halves every four years, the last halving occurred in 2016.

What is the best way to profit bitcoin mining?

First, you need to evaluate your current electricity cost, before anything else. This is typically measured per kWh. This is how much it costs a 1, 000-watt device to run every hour.

Second, you need to look at mining hardware options but do not purchase yet. Unless your electricity is free, you will not profit with anything lower than an Antminer S7, but even that is limited in profit. The Antminer S9 is the latest hardware, costing around $2000 USD and mines on average at 12 TH/s. It consumes around 1, 300 watts of power. So evaluate your upfront cost, including any import duty of your country. If you are in a hot climate, you can reduce the miner’s hash rate which reduces power consumption, but also reduces earnings. Most hardware cost does not include a power supply with high quality cables, this is required.

Fourth, you want to enter your hardware and electricity cost into a bitcoin mining calculator. Typically, with an electricity cost of $0.10 per kWh at the current exchange rate of $590 per bitcoin as of writing and $2000 upfront hardware cost, monthly profit is $153 USD, with $1866 after a year. This is at 12 TH/s, with a power consumption of 1300 watts, with a current difficulty of 217G. The difficulty is increasing over time though, slowly eroding your earnings every month. At those prices you are looking at over a year to break even with the best hardware. If your power is subsidized or ‘free’, you can greatly increase the profit margin. Free power will result in a $1000 profit after a year with the same hardware based on the current data, not taking into account difficulty increases or import duties as in EU countries and other countries. Only use gold or platinum power supplies, these are more efficient in converting mains voltage into lower voltages and thus cost less to run.

Fifth, once you are happy with your figures, and you are prepared to make the investment, make your investment, set up the hardware and mine!

What are the Limits of small scale mining operations?

There are many limitations of small scale mining operations, which can include:

1. Limit of power draw in your home. In countries with 220/240 volt supplies such as Europe, this is often 4800 watts, but room must be made for other devices such as fridges, oven etc. This figure is half in 110/120 volt areas such as the U.S and Japan. Check your wiring and breaker ratings as your electrics may differ.

WARNING! NEVER ATTEMPT TO REPLACE YOUR BREAKER WITH ONE OF A HIGHER RATING WITHOUT REWIRING AND FITTING BY A QUALIFIED ELECTRICIAN! OVERLOAD OF YOUR WIRING CAN CAUSE FIRE AND RISK OF INJURY/DEATH. IF IN DOUBT, CONSULT A QUALIFIED ELECTRICIAN! ENSURE CABLE RATINGS TO YOUR EQUIPMENT ARE RATED FOR THE LOAD YOU INTEND TO PUT THEM UNDER. ALSO, LOW QUALITY PSU CABLES NOT RATED FOR THE LOAD CAN MELT! ALWAYS FOLLOW THE MANUFACTURERS GUIDELINES FOR CABLE GUAGE.

2. Heat production, especially in hot climates and during summer months, which can be uncomfortable at best, and in the case of serious rises in temperature can cause illness. Under clocking to reduce heat and power consumption reduces earnings but can negate this issue.

3. Noise, especially in a small apartment this can cause noise that can become unbearable as the later gear is not quiet. Under clocking to reduce heat, and therefore fan speed and reduce the noise is recommended. Loud noise of over 90 decibels (dB) constantly can cause hearing damage in the long term with continued exposure.

4. Power grid reliability, if in a country with unreliable power can cause lost mining time, this should be factored into profits.

What are the pitfalls in mining for profit?

- Hardware breakdown outside of the standard 90-day warranty. This can leave the miner severely out of pocket.

- Larger scale operations due to the high power draw and heat requires proper electrical installations and installations of cooling, and possibly a three-phase electrical supply. This cost must be factored into calculations when investing in a mining farm.

- Insurance for large scale operations.

- Pool downtime, which can cause lost mining time. Set up failover pools for this scenario.

- Power usage should be measured at the wall, and this can vary depending on power supply quality. A gold or platinum rated power supply is best.

How do I secure my earnings?