Bitcoin mining pool profitability

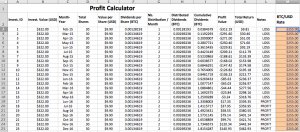

The short answer is cloud-hashing is not profitable as you might expect. You can still generate profit but its value is minuscule compared to the investment. To concretely answer this question, I'm going to share with you a model I developed to calculate profit from the cloud-hasing service (bit-miner.com).

The Investment

I bought a total of 30 shares for an investment value of 322$ (payment charges included) for 9.90$ a share. The service distributes dividends twice per month for the value of ~0.00128193 BTC per share.

The Math

Given the investment above, this service will put in my balance a total of ~0.0807714 BTC per month. Assuming the BTC/USD exchange rate is fixed at 255USD this means I will generate a revenue (not profit) of 20.59USD per month.

Now, let's assume my investment will span between February 2015 and December 2016, I will break even on if the BTC/USD exchange rate is still fixed at 255USD.

There are 3 ways this situation could evolve (from today the investment date):

- Best Case Scenario: The BTC/USD rate will increase and I will break even sooner and actually make more profit. For this profit to be substantial the rate should double if not triple (highly unlikely).

- Normal Case: If the BTC/USD rate is still the same, by the end of this investment period, I would have generated 1.815 BTC for a cost of 322USD and a profit of ~140USD (exch. rate BTC/USD 255USD)

- Worse Case: The BTC/USD rate will drop and eventually I will be at a loss. Or, the service owners will decide it is not profitable for them anymore (given the increase of the difficulty factor) and they will sell the hardware and distribute the returns based on the number of shares owned. The catch is that this hardware deprecates quickly and everyone will be at a loss by the time the owners decide to sell.

All in all, if you want to experiment and get involved in the bitcoin scene and have a few hundred dollars you want to spend here or there, go for it. If not, find other ways to procure/invest in bitcoins that are cheaper and faster.

Disclaimer: I'm not an economist or a financier, so please forgive any misuse of technical jargon.

- Edit: I edited the Google spreadsheet to take into consideration the mining difficulty. The impact is not large, but it makes the projections more accurate.*