Exchange credit card to Bitcoin

Have a credit card or debit card and want to buy/sell bitcoin (btc), litecoin (ltc) or other digital currency? There is nothing simpler if you use our service!

How it started

Credit cards as a payment method have a long history. The concept of using a card for purchases was described in 1887. It was a story from utopian novel, however. The fantasies became real in 1958 when Bank of America launched the BankAmericard in California. BankAmericard became the first successful recognizably modern credit card and with its overseas affiliates eventually evolved into the Visa system. In 1966 the ancestor of MasterCard was born when a group of banks established Master Charge to compete with BankAmericard. The same year Barclaycard in the UK launched the first credit card outside the USA.

Today world top card providers are Visa, MasterCard, Maestro, American Express and UnionPay. Now millions of people around the world use credit cards every day. Using a credit card the person can buy almost everything and pay for various services, from mobile recharge online to games.

Credit card benefits

Credit card offers such options as cash advance and overdraft. A cash advance is a short-term currency loan provided by most credit card issuers. The service allows cardholders to withdraw cash up to the credit limit (or some percentage of it). The maximum amount that can be borrowed and the frequency of the allowed advances vary depending on the terms and conditions of the credit card.

Overdraft is a loan arrangement under which a credit card provider extends credit up to a maximum amount (called overdraft limit) against which a customer can make withdrawals. It’s a type of revolving loan where credits are available for re-borrowing, and interest is charged only on the daily overdraft balance.

So, the main benefit of credit card to each customer is convenience. Compared to debit cards and checks, a credit card allows small short-term loans to be instantly made to a customer who need not calculate a balance remaining before every transaction, provided the total charges do not exceed the maximum credit line for the card.

Many credit cards offer rewards and benefits packages, such as enhanced product warranties at no cost, free loss/damage coverage on new purchases, various insurance protections. Credit cards can also offer reward points which may be redeemed for cash, products, or airline tickets.

Why do people choose our service?

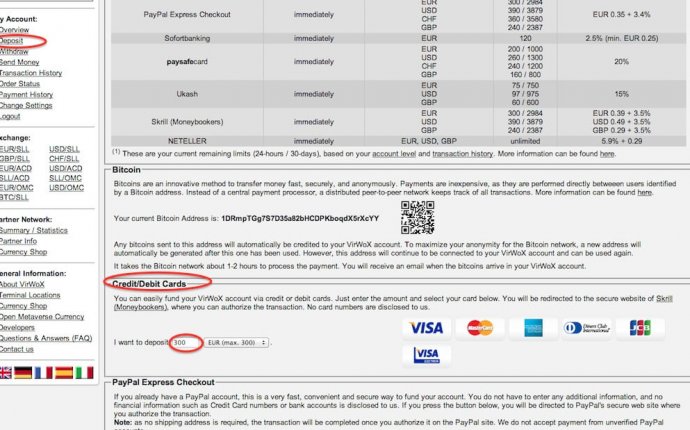

The advantages of this way of funding are instant transactions and the opportunity to buy Bitcoins on credit. However, it’s obvious that because of the high risk of accepting credit cards as a payment method for btc/ltc, the customer has to complete the thorough verification in this case. Initial limits might be rather strict (although after you will pay few orders without issues, the limits will be raised); and in case if our Fraud Prevention System will mark your order as suspicious, the payment might be hold for a while, untill our risk department will review the order. The fee for this payment method is little bigger comparing to others (because of the high cost of the payment processing).

247exchange is the only truly instant way to buy bitcoins with credit card, easy as any e-shop you've used before! We do not hold your funds, we deliver bitcoins instantly after the payment, you don't need to make trade orders and you'll know the exact price of 1 bitcoin before you'll have to pay!

As for withdrawal, despite it takes some time and is not instant - funding process takes 1-3 business days. Great advantage of our service is the possibility to withdraw Bitcoin to any credit/debit card (Visa or Mastercard), which are available anywhere in the world. 247exchange makes it possible to pay your credits, utility bills, make internet shopping, etc. using Bitcoin! All you need is to make withdrawal Bitcoin to your credit card. Risks of these transactions are much less then for funding Bitcoin using Credit card, so verification will be much simplier.