Cryptocurrency Arbitrage

Arbitrage refers to the process of instantly trading one or more pairs of currencies or odds for a nigh risk-free profit.

Usually, this involves two exchanges (this is then called a two-legged arbitrage); although more are, of course, possible.

There are several steps when executing an arbitrage:

- Find a suitable opportunity

- Execute trades

- Rebalance accounts

Step 1: Find a suitable opportunity

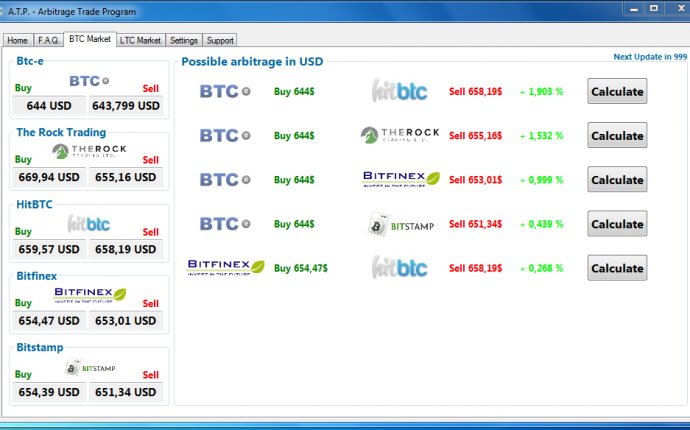

This step is relatively easy. Simply check the order books of as many exchanges as you like, compare bids vs asks, and check if you can find a negative spread.

A small discourse into what a spread is

I will assume you're familiar with bids, asks and what an order book is - if not, you should definitely look up those first. As for the negative spread, I'll elaborate a bit more on that. The spread is what is used to refer to the difference between bids and asks - lowest ask - highest bid = spread. This should be (and typically is) a positive value, since the best bid at an exchange must be lower than the lowest ask of an exchange - otherwise the matching engine of the exchange would settle these orders automatically.

In a perfect world, all markets and all market participants would have the same information, hence all top bids and all top asks of all exchanges would be the exact same, after fees were applied.

If you've seen the recent US elections, however, you're probably aware that the world isn't perfect, though. Hence, not all participants of a market know the same thing as the others, resulting in bids at exchanges which are higher than the asks at other exchanges - and this is what is called a negative spread.

Step 2: Execute trades

Let's assume you've found an amazing opportunity at exchange A and exchange B - a negative spread of 100$!

Exchange A: Ask 1BTC@450$ Exchange B: Bid 1BTC@550$

Luckily, you have proper funding at both to match these instantly - but how do you go about doing that? Easy! Just place an order on the opposite side at each exchange with the quote's prices!

Exchange A: Place Bid of 1BTC@450$ Exchange B: Place Ask of 1BTC@550$

Since your placed order match an order on the opposite side of the book, the trading engine matches them and the trade is settled, leaving you with a theoretical profit of a smooth 100$! Why theoretically, you ask? I'll get to that point further below.

Step 3: Rebalance Accounts

Unfortunately, you were only able to trade once today, but hey! Tomorrow's another day - but in order to be able to properly trade, you need to even out your balances. Right now, your accounts look like this:

Exchange A: 2 BTC | 50$ Exchange B: 0 BTC | 1050$

Hence, you go about and send 1 BTC from Exchange A to Exchange B, and 550$ dollars to Exchange A from Exchange B. No magic here - all accounts are re-balanced and you're ready to make a fortune again, tomorrow.

Exchange A: 1 BTC | 550$ Exchange B: 1 BTC | 550$

This all sounded wonderful? That's exactly what I thought when I first set out with my own arbitrage bot. However, there a some technical aspects that can really turn a sunny day into a poopy rain on your parade.

1. It needs to be as close to real-time as possible

This is possibly one of the hardest things to get right, and also the most underestimated aspect of arbitrage in crypto currency. The markets, compared to ForEx trading, are ridiculously slow - at busy exchanges, there may be a couple of dozen trades executed. Which gives the illusion, that polling data for bots via the most common API type, RESTful, is enough to trade risk-free. This is a misconception. Maybe for today this may appear to be enough - but what if markets picked up the pace? just 1 trade (or simply a placed order) within one second can change your opportunity from profit to loss.

christmas box coworking office manchester jamie oliver christmas gravy christmas sacks denver international airport coworking costa rica royal geographical society stylish clothes happy international women's day cancer research christmas cards how many business are there in the uk rush worldwide outdoor privacy screen outdoor foldable chairs outdoor birthday party ideas how to crowdfund a business how to start tea business outdoor markets near me today stylish name locket designs what is the role of business enterprise society room cool and stylish profile pictures for facebook for girls 2022 how to become an hr business partner outdoor store worldwide crossword clue what is informal communication how to start a business gta 5 online stylish workwear stylish cornish cottages mafia worldwide clothing